employee stock option tax calculator

An employee stock option is a form of equity compensation that is offered to employees and executives by upper management. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b.

Esops In India Benefits Tips Taxation Calculator

This is calculated as follows.

. Employee Stock Option Fund. Enter the current stock price of your company the strike price of the options the number of options you are entitled to an. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net proceeds.

If the stock was disposed of in a nonqualifying disposition the basis is the sum of these. The Employee Stock Options Calculator. The plan was an incentive stock option or statutory stock option.

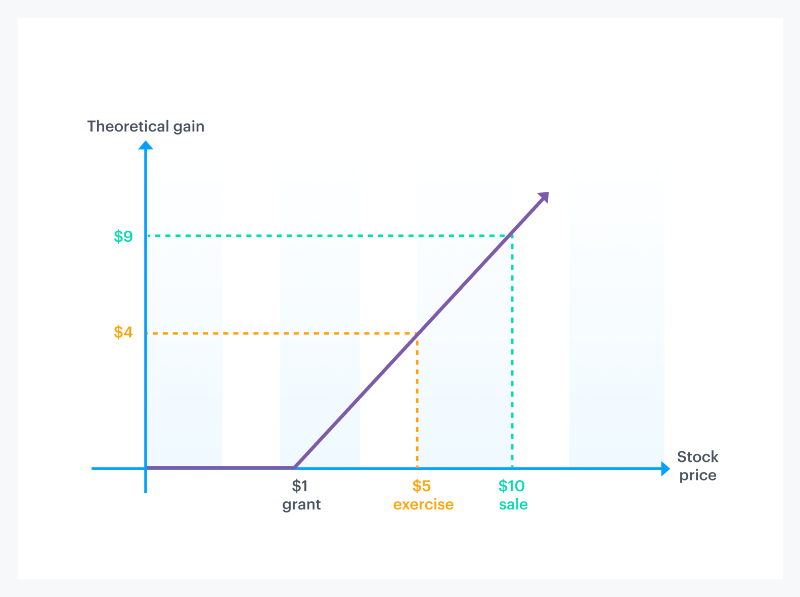

Calculate your potential gains after taxes. This permalink creates a unique url for this online calculator with your saved information. That means youve made 10 per share.

If youre a startup employee earning stock options its important to understand how your stock options are taxed. The Stock Option Plan specifies the employees or class of employees eligible to receive options. When cashing in your stock options how much tax is to be withheld and what is my actual take-home amount.

This is based on the strike price and the. Your costs have two parts. The stock is disposed of in a qualifying disposition.

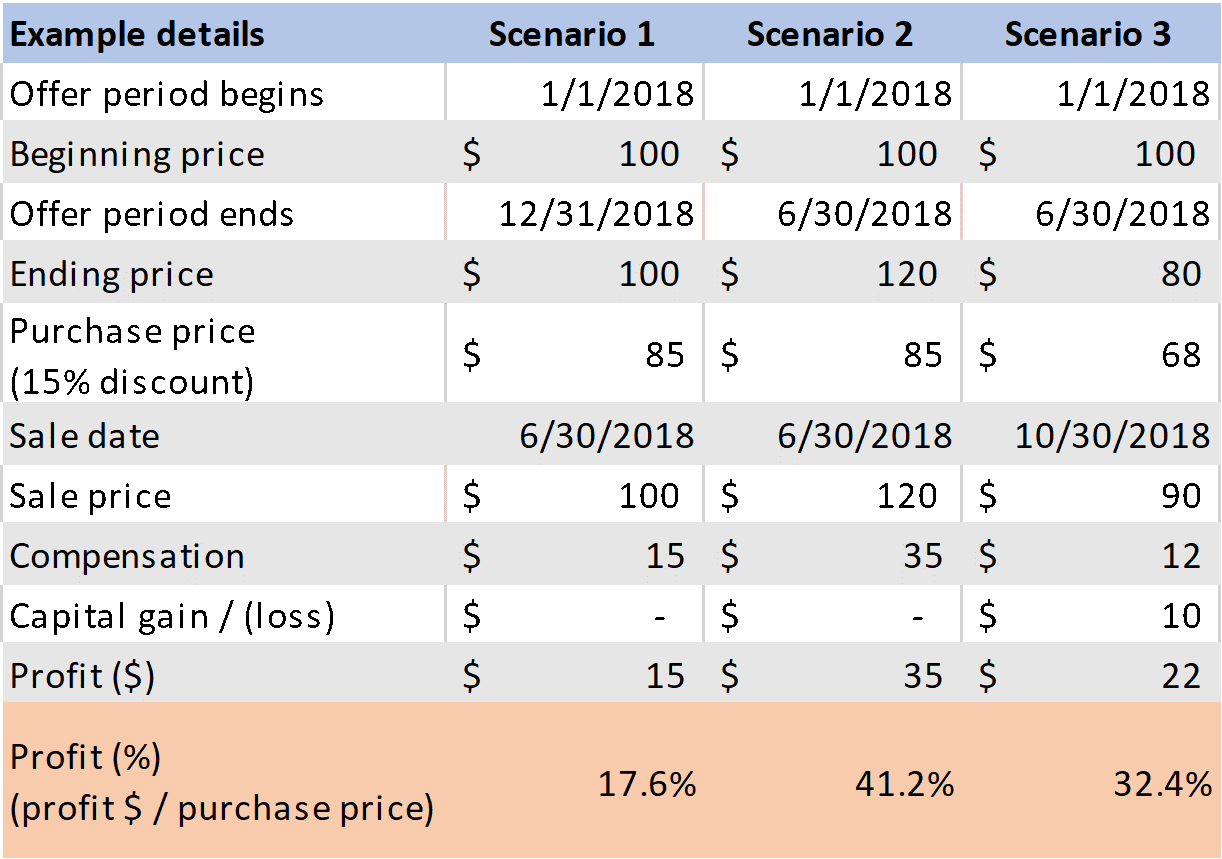

For use with Non-Qualified Stock Option Plans. Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment. Your payroll taxes will switch to 145 on earnings over the base once your earned income reaches the base.

If your eyes just glazed over we get it taxes arent fun. The exercise price is 12. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share.

When you hold your investment for over a year youll qualify for the preferential long. Building your knowledge will give you more power to plan your. You will pay a total of 765 on gains if your year-to-date earned income is less than the base when you exercise NQ stock options.

Cost of Shares10000 shares 1 10000. But hear us out. The cost to buy your options and taxes.

So if you have 100 shares youll spend 2000 but receive a value of 3000. The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. Many companies offer employee stock options which often lead to employees buying shares in the company at a discount.

It can also show your worst-case AMT owed upfront total tax and its breakdown and the allocation of income depending on your exercise. The Stock Option Plan specifies the total number of shares in the option pool. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. Please enter your option information below to see your potential savings. The default value of an NSO is 20 per share.

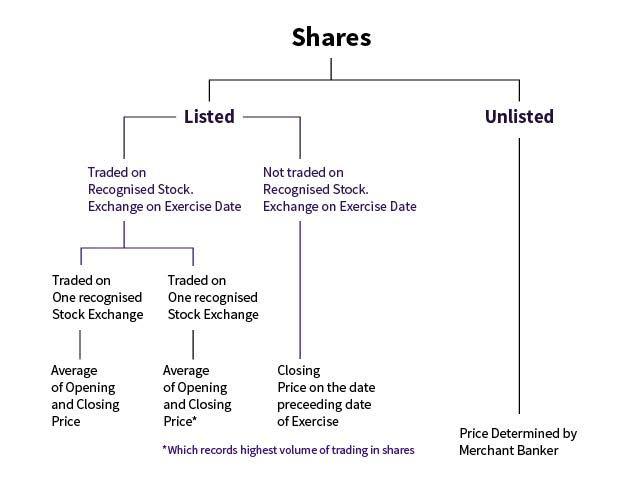

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Taxes for Non-Qualified Stock Options. There are two primary forms of stock options ISOs and NSOs.

Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value. If the plan was a nonstatutory stock option your basis. This form will report important dates and values needed to determine the correct amount of capital and ordinary income if applicable to be reported on your return.

On this page is an Incentive Stock Options or ISO calculator. How much are your stock options worth. The most significant implication for employees is.

You should not exercise employee stock options based only on tax factors but you will pay payroll. Emily made an Exercised Share Profit of 20000. This calculator also finds your current stock price when entering a ticker symbol.

Any income reported on your W-2 as a result of the disposition. This information may help you analyze your financial needs. This amounts to 8000 in ordinary income.

Value of Shares10000 shares 3 30000. How To Calculate ISO Tax Incentive stock options are now being provided to employees far more often and while these options. To arrive at your potential take-home gains youll need to subtract your costs from the resulting gain in the stocks value.

The calculator is very useful in evaluating the tax implications of a NSO. The following calculator enables workers to see what their stock options are likely to be valued at for a range of potential price changes. In the event that you are unable to calculate the gain in a particular exercise scenario you can use the default value of the NSO.

999 Baker Way Suite 400 San Mateo CA 94404 tel1 650 262-6670. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Abbreviated Model_Option Exercise_v1 - Pagos.

This calculator illustrates the tax benefits of exercising your stock options before IPO. How To Calculate Iso Tax. Exercising your non-qualified stock options triggers a tax.

Abbreviated Model_Option Exercise_v1 -. It is important to be educated on the tax implications of stock options before an option is finalized and accepted. Employee stock options can provide a big incentive for employees to join and stay at a company as well as work towards the companys success.

The options were granted within. Your company-issued employee stock options may not be in-the-money today but assuming an investment growth rate may be worth some money in the future. Lets start with the cost to buy your options.

Using the ESPP Tax and Return Calculator. Employee Stock Option Calculator for Startups Established Companies. Youll either pay short-term or long-term capital gains taxes depending on how long youve held the stock.

The complete guide to employee stock option taxes. Many companies offer employee stock options which often lead to employees buying shares.

How Stock Options Are Taxed Carta

How Stock Options Are Taxed Carta

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On Sensible Financial Planning

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Employee Stock Options Financial Edge

Tips To Make The Most Of Your Esops Businesstoday

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Rsu Taxes Explained 4 Tax Strategies For 2022

How Much Are My Options Worth Eso Fund

Getting Esop As Salary Package Know About Esop Taxation

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Option Eso Definition

Stock Options 101 The Essentials Mystockoptions Com

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Option Eso Definition

Employee Stock Options Financial Edge

Video Included What Is An Employee Stock Option Mystockoptions Com

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)